by Katie Conroy (kconroy@advicemine.com)

It can be stressful if you’re hoping to buy a home in the next year but are unsure how to get your credit profile in good shape for a lender. Luckily, there are some easy steps, presented by Coldwell Banker Pro West, you can take to get your finances in order even when you have debt.

Know Your Numbers

It’s important to see the whole picture of your credit profile before you start trying to fix things. Use a free credit report site or app to see what lenders review when you apply for a mortgage. On it will be all your debts, payment history, any derogatory marks you have against you and other factors that potential lenders consider. Make a list of the debts on the report and what the interest rate is for each of them. If there are any accounts in collections, they should be the top priority, as derogatory marks have a high impact on your credit score.

Create a Budget

Using your list as a guide, create a budget for you and your family. There are free budgeting templates online, or you can go about it yourself. Make a list of all monthly expenses, excluding your debts, such as groceries, gas, and rent. Consider dropping subscriptions you can do without and extra expenses you can temporarily suspend to have more money to put toward paying down your debt and saving for a home.

Total up the costs and deduct that number from the amount of income you bring in during a month. Whatever is left over is what you have to put toward debt payoff. There are two primary schools of debt payoff and they yield similar results: snowball and avalanche.

Say you have $100 on a credit card, $2,000 on a car, and $4,000 on a personal loan. With snowball, you start with your smallest debt: the credit card. You pay it off first, then you put the money you would usually put toward it as an extra payment on your car until it’s paid off, and then you do the same with your personal loan. With avalanche, you focus on the interest rates of your debt, starting with the debt that has the highest interest rate and directing payments there.

Do Your Research

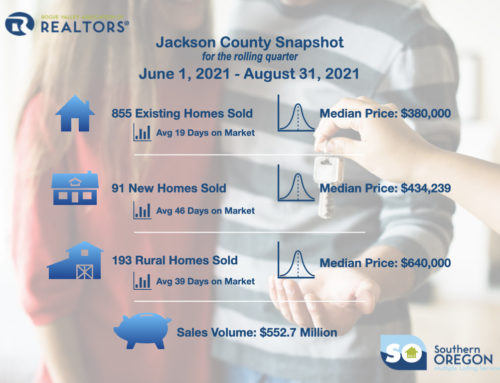

In order to save effectively, you have to know what you should be saving. Research the market you’re looking to buy in. Find houses for sale in Medford similar to what and where you would like to purchase and calculate what kind of down payment you need.

Although 20 percent down is often toted as the goal, not all loans require that much, so be sure to research your loan options before setting a down payment goal. Remember that you will also need to pay closing costs and potentially points if you’re looking to lower your interest rate.

Make the money that you are saving up work for you by researching the best savings accounts with the highest interest rates. That percent or two can make a real difference when you are trying to save up for a big expense like a home.

Managing your money doesn’t have to be difficult. Get your numbers in order and work smart and hard to get the most out of them, and you’ll be closing on your dream home in no time.