The COVID-19 pandemic has had a noteworthy impact on homeownership. Although the virus continues to take a toll and unemployment remains above pre-pandemic levels, the housing market has been booming, and trends are starting to emerge, according to the National Association of REALTORS®’ newly released “2020 Profile of Home Buyers and Sellers.”

The profile, produced annually, contains a new section this year that examines how the pandemic is affecting people’s attitudes and purchase and sales decisions. This year’s report reflects responses from more than 8,000 Americans surveyed between July 2019 and June 2020.

“The coronavirus without a doubt led home buyers to reassess their housing situations and even reconsider home sizes and destinations,” says Jessica Lautz, vice president of demographics and behavioral insights for NAR. “Buyers sought housing with more rooms, more square footage, and more yard space, as they may have desired a home office or home gym. They also shopped for larger homes because extra space would allow households to better accommodate older adult relatives or young adults that are now living within the residence.”

Trends Emerging Among Buyers Since the Pandemic

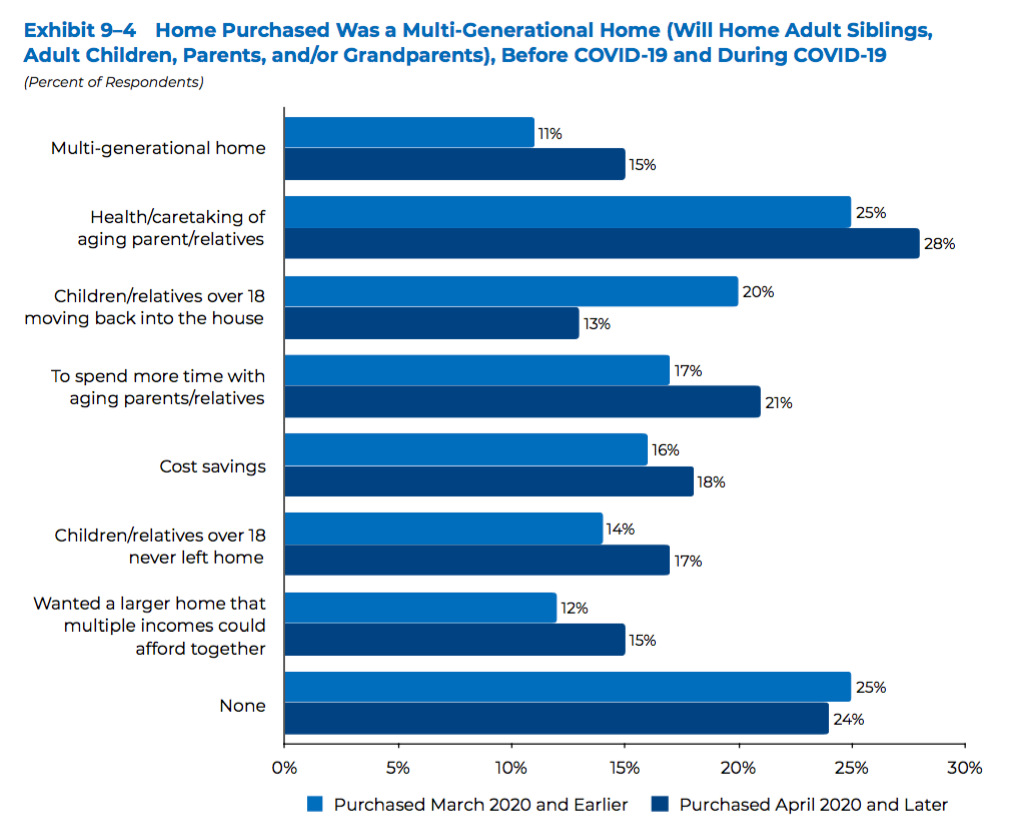

1. Multigenerational homes grow in popularity: With people sheltering in place, buyers are showing an increasing desire to bring more family members under one roof. Buyers purchasing after the start of the pandemic in the U.S. were more likely to purchase multigenerational homes—15% versus 11% who purchased prior to April 2020. They cited multiple reasons, such as the health and caretaking of aging parents and relatives, cost savings, the desire to spend more time with aging parents and relatives, and the need for the delayed independence of children. They also said buying a multigenerational home allowed them to pool multiple incomes to purchase a larger home.

2. Homes are pricier: Those purchasing after March were more likely to purchase a more expensive home—$339,400 compared to $270,000 for those who purchased before April. What’s more, 23% of buyers who purchased after March purchased a home that was $500,000 or more. Those who bought after the COVID-19 outbreak began tended to have higher incomes: $100,800 compared to $94,400 for pre-April buyers.

3. Shorter house tenures are expected: With the pandemic driving some purchases that might otherwise have been delayed, it’s unsurprising that some buyers see the purchase as a stepping stone. Those who purchased after the COVID-19 outbreak say they plan to stay in their home a median of 10 years compared to 15 years for those who purchased in the nine months prior to the pandemic.

4. More renters become owners: The pandemic has driven home purchases among those who were renting an apartment or house. Prior to April, about 36% of home buyers were coming from the ranks of renters; since then, the percentage has jumped to 45%.

5. Buyers show love to suburbia: Among buyers who purchased between April and June of this year, 57% picked a suburban location, compared to 50% of pre-pandemic buyers. Buyers haven’t abandoned urban areas, however. Prior to the pandemic, 12% of buyers purchased in an urban area or central city; since April, that percentage has increased slightly to 14%.

6. Searches speed up: Buyers who purchased after March searched for just two weeks before working with an agent; those who purchased before the pandemic searched for three weeks before contacting an agent. In addition, buyers who purchased after the start of the pandemic have been more strategic in their home search, limiting how many homes they view in person. Since the pandemic began, buyers have walked through a median of eight homes in person, slightly lower than the nine homes prior. When choosing an agent, buyers who purchased after March were more likely to turn to friends or family members. This is possibly because buyers were taking precautions and limiting contact with people outside their immediate circle, the report posits.

7. Certain buying segments grow: While married couples continue to be the largest segment of home buyers, others increased their purchases during the pandemic, particularly unmarried couples and some minority groups. Before the pandemic, single females were the most likely after married couples to purchase real estate, but their share has dropped from 18% to 14% during the coronavirus outbreak. On the other hand, unmarried couples increased their share (rising from 9% to 11% of all buyers), as are “others” (rising from 2% to 3%), a category that likely reflects roommates, the report notes. The Hispanic/Latino share of home buyers increased since the coronavirus outbreak (rising from 7% to 9%). Asian/Pacific Islander buyers also have doubled as a share of the buyer market (rising from 4% to 8%), the report shows. Black/African American buyers remained at a 5% share of buyers during both periods. White buyers still made up a majority of purchasers, but their share declined slightly, going from 84% of buyers pre-pandemic to 82% in the months since March.